“War Has Always Been Good for Business”: Israel’s Strike on Iran Triggers Windfall for Arms Firms and Oil Billionaires

June 14, 2025 — In the early hours of June 13, Israel launched a massive airstrike operation, dubbed "Rising Lion," targeting over 100 sites in Iran, including nuclear facilities and military infrastructure. The operation resulted in the deaths of several high-ranking Iranian officials, including IRGC Commander Hossein Salami and Chief of Staff Mohammad Bagheri.

The immediate aftermath saw Iran retaliate by launching dozens of ballistic missiles into Israel, leading to casualties and widespread alarm. The United States, while denying direct involvement in the initial Israeli offensive, played a critical role in assisting Israel in intercepting the barrage of Iranian missiles. U.S. military forces deployed both Patriot and Terminal High Altitude Area Defense (THAAD) systems from its bases in the Middle East and utilized a Navy destroyer in the eastern Mediterranean Sea to shoot down incoming missiles.

The escalation in geopolitical tensions caused a significant surge in global oil prices. Brent crude futures reached $78.50 per barrel, their highest level since January. The Dow Jones Industrial Average dropped 769.83 points (1.79%) to 42,197.79, while the S&P 500 and Nasdaq declined 1.13% and 1.30%, respectively.

Amid the turmoil, the U.S. State Department informed Congress of plans to sell nearly $3 billion in weapons to Israel, including thousands of bombs and $295 million worth of armoured bulldozers. This follows previous arms sales, with the U.S. having sent Israel more than 10,000 highly destructive 2,000-pound bombs and thousands of Hellfire missiles since the start of the Gaza war in October.

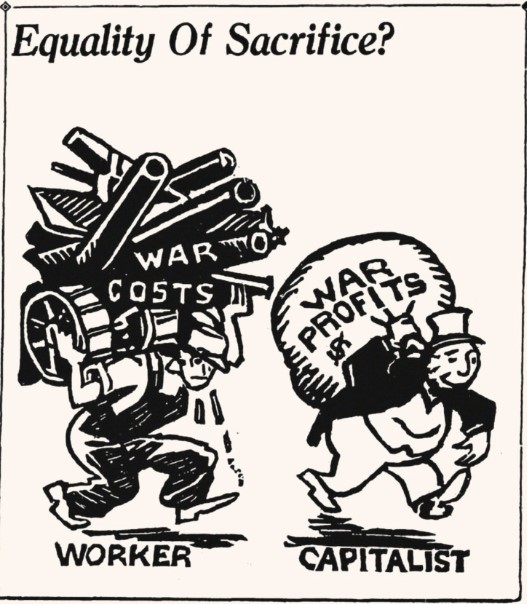

The confluence of military action and economic gain has raised concerns about the influence of the military-industrial complex and oil interests in perpetuating conflict. As tensions continue to escalate, the beneficiaries appear to be those with vested interests in defence contracts and oil markets, while the broader implications for regional stability remain uncertain.

When Israeli warplanes launched a wave of targeted airstrikes against Iranian military installations in Esfahan, the tremor rippled far beyond the Persian plateau. The sound of detonations in Iran’s desert was heard clearly in Washington boardrooms and Riyadh investment banks — an ominous but familiar prelude to economic opportunity for the globe’s most fortified interests.

Even before the dust had settled, defence contractors’ stock tickers flashed green. Within hours, shares in Lockheed Martin, Raytheon, Northrop Grumman, Rafael Advanced Defense Systems, and Elbit Systems had surged by between 4% and 9%. The Nasdaq’s defence index posted its best single-day performance since the U.S. withdrawal from Afghanistan in 2021. Traders called it a “dead cert rally.” Human rights monitors called it something else entirely: war profiteering in real time.

The military-industrial complex — a term coined by U.S. President Dwight D. Eisenhower in 1961 as a warning — now operates with seamless integration across Israeli, American, British, and Gulf defence sectors. The Israeli strike may have been tactically surgical, but its strategic consequences have been global and unmistakably lucrative.

The Bombs That Pay Dividends

Officially, Israeli defence officials described the operation as a “pre-emptive” and “limited” response to Tehran’s suspected enrichment activities at Natanz and covert drone manufacturing facilities near Yazd. But insiders in both Israeli and U.S. national security circles privately admit the strike was more than deterrent; it was a message — not only to Iran, but to a region whose economic architecture is now fused with weapons sales.

In Washington, lobbyists for major defence firms were already laying groundwork for expanded weapons packages to Gulf allies under the banner of “regional reassurance.” Congressional aides confirmed that emergency procurement proposals — including upgraded missile defence systems for Saudi Arabia and the UAE — were circulating even before the Pentagon had fully assessed the fallout of the attack.

The timing is no coincidence. The Israeli strike has opened a floodgate of regional anxiety — and where anxiety reigns, so do contracts. "There's a clear pattern," said a former Pentagon procurement official. "A strike like this doesn't just have battlefield consequences. It drives procurement cycles, pushes emergency authorisations, and opens spigots of funding."

Petro-Profits in a Time of Tension

As the Gulf States publicly called for restraint, their backchannels were alive with opportunity. Global oil prices spiked. Brent crude surged. The gains were particularly welcome news for Aramco, the Saudi oil giant that remains the world’s most profitable company, and for private energy conglomerates heavily invested in instability premiums.

Among the beneficiaries: a constellation of billionaires and sovereign wealth funds whose fortunes are deeply intertwined with fossil fuel futures. The Saudi Public Investment Fund (PIF), chaired by Crown Prince Mohammed bin Salman, reaped windfall returns on speculative oil positions, while private equity firms in London and Houston saw record earnings from Middle East-focused energy ETFs.

Blackstone, Carlyle, and Apollo — all of whom maintain both energy and defence portfolios — reported gains across multiple vertical. "Volatility," one fund manager quipped, "is our most reliable asset."

Tel Aviv, Riyadh, and the Iron Triangle

Though they share no formal diplomatic relationship, Israel and Saudi Arabia are increasingly bound by overlapping security interests — particularly when it comes to Tehran. For Riyadh, every confrontation between Israel and Iran reinforces the narrative of an ever-present Shiite threat, strengthening Saudi Arabia’s case for acquiring more advanced Western arms.

Earlier, the US administration quietly approved the transfer of THAAD and Patriot missile systems to Saudi Arabia, and was considering a modified F-35 export package under the Abraham Accords framework. Israeli defence contractors, emboldened by U.S. technology-sharing waivers, are increasingly collaborating with Gulf-based entities on drone defence, AI-based targeting systems, and maritime surveillance tools.

"Israel drops bombs," said one European defence analyst. "And Riyadh orders more interceptors. It’s not a cynical cycle — it’s a business model."

Blood in the Water, and on the Balance Sheet

To be clear, Iran’s regional activities have long drawn scrutiny. Its support for Hezbollah in Lebanon, proxy militias in Iraq and Syria, and Houthi rebels in Yemen poses real and complex threats. But Israel’s calibrated strikes — like the one in April — rarely change these strategic realities. What they do shift is the psychology of markets.

Insurance premiums for shipping through the Strait of Hormuz — through which one-fifth of the world’s oil flows — have risen sharply. Defence attachés across the Gulf have requested expedited threat assessments. The Pentagon’s regional command, CENTCOM, has increased its naval presence — a move that all but guarantees higher demand for replacement parts, contractors, and logistics services.

And then there are the less visible beneficiaries: cyber-defence firms riding the wave of escalation chatter, consultancy groups packaging “risk insights” for state clients, and satellite surveillance start-ups angling for Pentagon contracts in contested airspace.

The True Cost: Accountability

Amid the profits and platitudes lies the uncounted toll. Civilian casualties from the Israeli strike remain unclear, but Iranian health authorities have reported at least 78 deaths at the time of writing, including factory workers and bystanders. Internet blackouts and fuel shortages in affected provinces have triggered humanitarian concerns, though these rarely make headlines in financial filings or shareholder calls.

There’s a disturbing level of normalisation when it comes to violence as market stimulus. We’ve gone beyond the realm of military deterrence. We are now watching warfare become part of portfolio diversification.

Israel, for its part, maintains the strike was necessary and proportionate. Yet no senior official has commented on the global financial surge that followed — nor on the interwoven machinery that continues to reward escalation over diplomacy.

In the shadow of every explosion, fortunes are made. And as this latest conflict spiral shows, the beneficiaries are rarely those who live beneath the bombs — but rather those who bank on them from afar.

Comments

Post a Comment